Auvesta Review - ¿Is it safe? - Read Before Buy Gold

In this auvesta review we take a detailed look at all opinions on Auvesta to determine if it is a safe company to buy gold and precious metals or if it a scam.

In this auvesta review we take a detailed look at all opinions on Auvesta to determine if it is a safe company to buy gold and precious metals or if it a scam.

If you are like me, surely you feel identified with one of the following thoughts at some point.

If you have been or are in any of these situations, this opinion on Auvesta may be interesting to protect your savings or simply diversify your portfolio and create a wealth for your retirement in gold and precious metals.

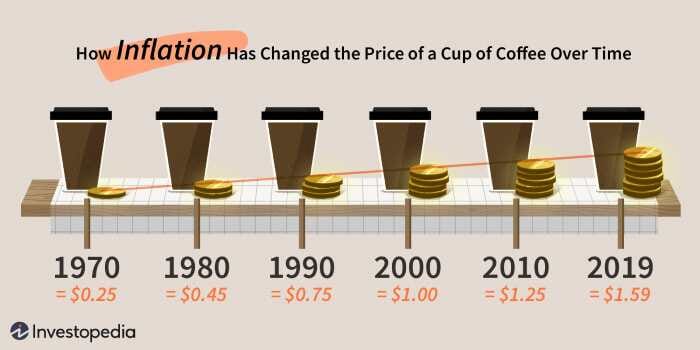

A savings plan in gold and precious metals is similar to your savings account in the bank, only that your money is not affected by inflation and it is also away from the financial market and outside the reach of governments.

The savings plan gives you the freedom to make contributions at your own pace, when, how and how much you want.

With this plan you will be able to create assets to protect your future and protect yourself against inflation in the medium and long term.

It is a flexible plan without conditions, you do not have deadlines.

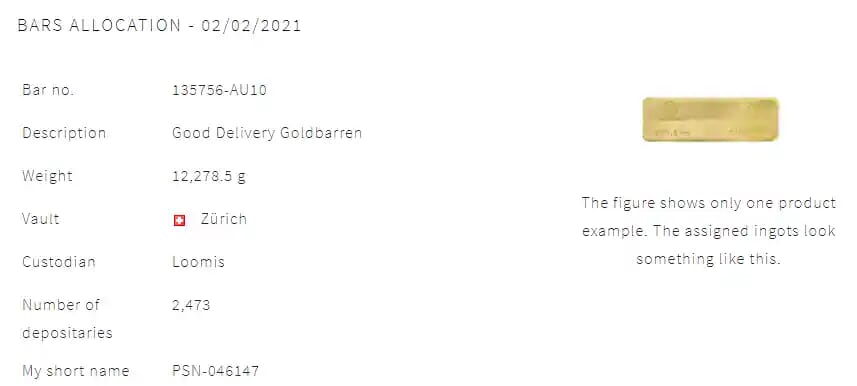

In this way we are buying gram by gram parts of Good Delivery bullion (purity 999.9), which are the official 400-ounce (12.44 kg) bullion used by central banks or governments to accumulate their gold reserves.

You have the opportunity to save in bullion and / or coins.

Being gold and precious metals, the underlying is not affected by inflation.

See in the image how inflation affects the price of a coffee over time and how it can affect your savings.

Source: Investopedia

Inflation is that silent thief who takes your money without you noticing.

Auvesta also gives you the possibility to invest in gold, silver, platinum, palladium or investment coins in a traditional way.

You will be able to diversify and complement your investment portfolio.

For both services you have 2 storage possibilities:

What does it mean for gold to be allocated?

It means that the client owns the legal ownership of the gold or precious metal. In other words, the company cannot negotiate with our ingot.

The same does not happen with unallocated gold, which is similar to when we deposit money in our bank, that money is not reserved in our name. The bank can use our money to lend or invest it.

Up to 15% cheaper than its competition.

With the savings plan, you can buy small pieces of precious metal bullion at cheaper prices than if you bought pieces of that size in any store.

It is not the same to buy a 10 gram piece in a store than to buy 10 grams of a bullion to accumulate in a savings plan.

The bars or mini ingots of 1, 5, 10, 100 or 1000 grams that are bought in a store carry an extra price because they carry costs of minting, transport and are manufactured for sale.

The purchase price of Auvesta is about 10% of the price of the metal, since it is assigned metal (of your property) and therefore has associated some handling and storage costs.

Storage is carried out in specialized companies that are responsible for safeguarding the gold of most of the world's reserves.

They are kept in Brinks, Loomis and Prosegur.

There is an insurance value of 50 million euros, mainly designed for the institutional client but which we can now enjoy by individuals.

The company has a daily stock certificate that can be viewed by each customer in their account.

Storage costs are cheaper than a safe in a bank for a simple reason: the bars are shared between several clients.

azón: the bars are shared between several clients.

If you decide to sell the amount you need, Auvesta transfers the money to your bank account in less than 24 hours or that same day for operations before 11 in the morning.

The savings plan consists of making periodic contributions to create our wealth gram by gram in gold, silver, platinum, palladium or coins.

In this video they show you how it works:

It has an entry premium of € 2,250 that they return to you with 5% bonuses on each successive contribution.

This means that, if we start with € 3,000 initially, € 2,250 goes to complete the premium and the rest, € 750 goes to the purchase of precious metal.

It works the same as when we buy a house and make a down payment, only if we back down on the house purchase, we lose the down payment.

Not here, in Auvesta you get the premium back with a 5% bonus on each contribution as long as there is a premium to recover.

There are 3 savings accounts:

The only one that allows you to recover the entire premium is the Premium account, so I do not recommend the Smart or the Business, since the conditions and the price are not worth it. Also, you do not get the entire premium back.

Imagine that you open a premium account with an initial amount of € 2,500:

Of which € 2,250 goes to complete the premium and € 250 to the purchase of gold.

By making a subsequent contribution we will have a 5% bonus that would be added to the purchase of precious metal

For example, we make a contribution of € 1,000, we would receive a 5% bonus (€ 50) for which we would buy gold worth € 1,050

Those € 50 are subtracted from the premium that they have to return to us. In this case we would have € 2,200 to recover = € 2,250 - € 50.

In this table it is a little clearer:

| Savings Plan Simulation - Premium Account | |||||

|---|---|---|---|---|---|

| # month | contribution | bonus 5% | gold quantity | total gold | remaining deposit |

| 0 | 3250€ | 50€ | 1050€ | 1050€ | 2200€ |

| 1 | 1000€ | 50€ | 1050€ | 2100€ | 2150€ |

| 2 | 1000€ | 50€ | 1050€ | 3150€ | 2100€ |

| 3 | 1000€ | 50€ | 1050€ | 4200€ | 2050€ |

| 4 | 1000€ | 50€ | 1050€ | 5250€ | 2000€ |

| ... | |||||

If you want to start with less than € 2,250 there is no problem, I will explain it below in the frequently asked questions:

Each client has access to the serial number of each bar and geographic location, as well as the total number of owners of that same bar

You can also see the company's metal stocks each day in a report within each personal account.

The DFSI (German Finance Ministry) designates a law firm that audits every 2 months that the amounts that appear in the client's warehouse coincide with the physical stocks in the custodial companies. We can also see that report in our account.

Auvesta collaborates with manufacturers certified by the LBMA, which is the only association that certifies the quality of good delivery bars.

Commissions only apply to the purchase price, there is no commission when we sell.

This is the only commission for your service.

There are only transport costs when we ask for the shipping and storage that the companies that offer the service have. No hidden fees appear.

Gold has appreciated 600% since 2000, obviously no one can guarantee any future returns.

Despite the above, the growing demand for gold in electronic devices and jewelry, coupled with the fact that it is a rare commodity, makes it quite likely that the trend will continue to be upward.

Auvesta Edelmetalle AG is a German company with more than 35 years of experience in the precious metals sector and present in more than 120 countries at the time of writing this review.

It has mainly been dedicated to institutional clients and as of 2012 it also offers its services to private clients.

It has been selected among more than 40 German metal brokers as the best German precious metals trader by the German magazine Focus Money and the DFSI (German Ministry of Finance).

The company is audited by independent German companies who have awarded it the certificate for the best creditworthiness.

There are several alternatives to invest in physical gold, although currently they do not exactly have the regular purchase service.

Like:

In our opinion Auvesta is a serious and proven company that has services that can help us to easily create a wealth in gold and precious metals to protect our future in the medium long term.

Storage prices are relatively low and also deposits are insured, compared to storing them on our own or keeping them in a safe at a bank.

And finally, it offers immediate liquidity to transfer our money to our account without commissions. The same day or the day after the order the money is in our account.

You can start with any amount over € 100.

If the initial amount is higher than the premium of € 2,250, you will enjoy a Bonus of 5% on the following contributions and you will start to recover the premium from the beginning.

If it is less than € 2,250, then a 70-30% will be applied:

For example: Imagine that you start with a contribution of € 1,000, the distribution would be:

Contribution #1 (€ 1,000):

Contribution #2 (+ € 1,000):

Contribution #3 (+ € 1,000):

Contribution #4 (+ € 1,000):

Once the premium has been covered (€ 2,250) you will begin to receive the bonus of 5% of each contribution to recover the premium.

You can invest in a traditional way for amounts from € 50,000, without limit and with advantages in the purchase price and the storage price.

If the amount is less than € 50,000 you can do it with a savings plan (capital accumulation).

You are free to make contributions as, when and how much you want, as if you did not contribute.

Auvesta does not take the money from your account, only you can make contributions by bank transfer or credit card (from the first contribution).

Normally, an order of periodic transfer in your bank account and modify it in case of having to change the contribution.