Guide to open a physical Gold Savings Plan

Detailed Guide to open a physical Gold Savings Plan that explains what a plan to Save in Gold consists of and how to minimize investment risks.

Detailed Guide to open a physical Gold Savings Plan that explains what a plan to Save in Gold consists of and how to minimize investment risks.

When it comes to retirement savings or pension plans, what do you imagine?

You are not the only one. These options make up the majority of traditional savings plans, such as retirement plans/en/blog/gold-savings-plan/. And for many, they are the only place where they keep their long-term savings.

Unfortunately, these traditional options offer neither the security nor the flexibility that most people require.

This all adds up to the fact that most traditional savings plans offer zero flexibility and (worse) can be completely decimated by economic turmoil, slumps, and stock market crashes..

And for those who have spent years and decades of their lives saving money for a more comfortable future ...

There's nothing more frustrating than 20-30 years of savings going down the drain in a matter of weeks.

If you want a plan for the future that protects you and your family, this is the best gold savings plan that I know.

In the last 20 years, from 2000 to 2020, we would have obtained a 534% profitability if we had followed a gold savings plan.

Suppose we had started a gold savings plan in January 2000 with the following characteristics:

In view of the graph, we see that the net profit would have been $ 267,040, or what is the same, a annual return of 9.12% and a total capital of $ 317,040.

This is the advantage of carrying out a capital accumulation plan, or what is the same, regular contributions over a certain period, since we average in price and from this In this way we also avoid the risks of volatility of the underlying asset.

Obviously, we cannot guarantee that gold will behave the same way in the next 20 years, but the following criteria can help:

Creating a gold savings plan is the best way to prepare your savings for the future, protect against inflation and ensure complete control over your assets .

That is why investing in gold has always been the best way to protect your wealth.

That's because investment gold is:

But the question is, who should you trust when creating your gold savings plan?

We will answer this question later.

Before we will talk about the risks that physical gold can have

Apart from the intrinsic risks of investing in physical gold, due to counterfeits and the problem of storage, since it is a small-sized but high-value good, the main problems are:

To give you an idea, about 8,000 - 10,000 million dollars of physical gold are traded / year, while the volume of paper gold is about 20,000 - 30,000 million dollars / day. As you can see, there is a huge imbalance and this is the reason why ETFs are not backed by gold reserves.

The situation has been resolved because there was enough metal on the market, but what would have happened if there was not enough?

So even though the gold is assigned, leaving it in the hands of the bank for safekeeping is a risk.

Experts recommend that even if it is assigned gold, it is not convenient to leave it in the safe deposit boxes of the banks since by the "Bail In" law - banks can recapitalize from bank assets - banks can make use of the metal in case of crisis or solvency problems.

Therefore, to avoid risk as much as possible, the main thing is to have an operator that guarantees total security when investing in gold and offers the guarantees and quality certificates that ensure the purchase of gold or precious metals as well as their storage.

It is an alternative to traditional pension plansonales, without the inconvenience or penalties to get our money back.

The company that I know and where I have my savings plan is Auvesta, a German multinational present in more than 100 countries.

Auvesta is the leader in precious metal savings products (gold, silver, platinum and palladium) in Europe according to Focus Money magazine, in addition to being awarded by the German Ministry of Finance as:

Let's see the operation of the gold savings plan:

In case of withdrawing your money, your deposit will continue to be recovered through contributions.

The first payment is the deposit, € 2,250 + the amount you want to start saving periodically

If you make a contribution of € 1,000 they add an extra bonus of 5%, I explain it better in the following table:

| Savings Plan Simulation - Premium Account | |||||

|---|---|---|---|---|---|

| # month | contribution | bonus 5% | gold quantity | total gold | remaining deposit |

| 0 | 3250€ | 50€ | 1050€ | 1050€ | 2200€ |

| 1 | 1000€ | 50€ | 1050€ | 2100€ | 2150€ |

| 2 | 1000€ | 50€ | 1050€ | 3150€ | 2100€ |

| 3 | 1000€ | 50€ | 1050€ | 4200€ | 2050€ |

| 4 | 1000€ | 50€ | 1050€ | 5250€ | 2000€ |

| ... | |||||

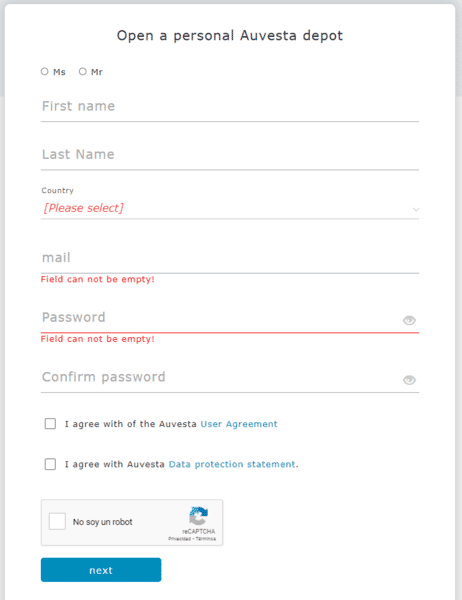

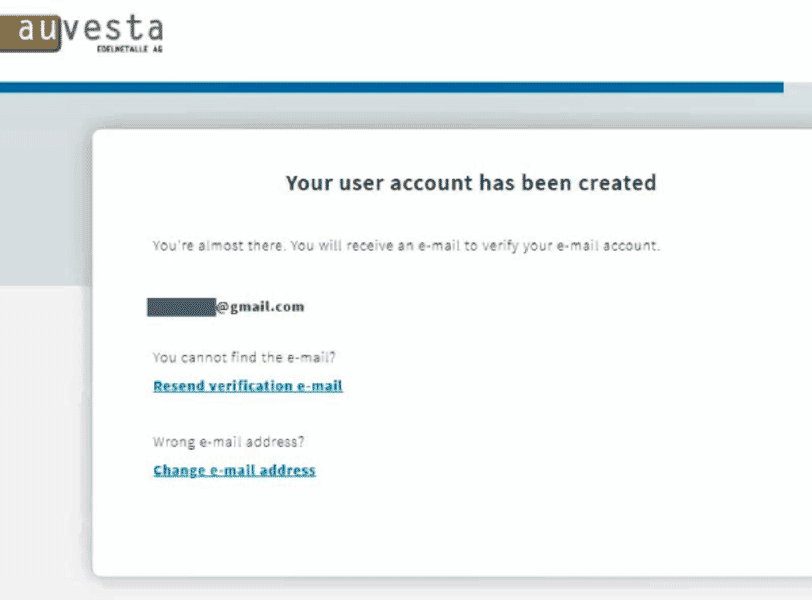

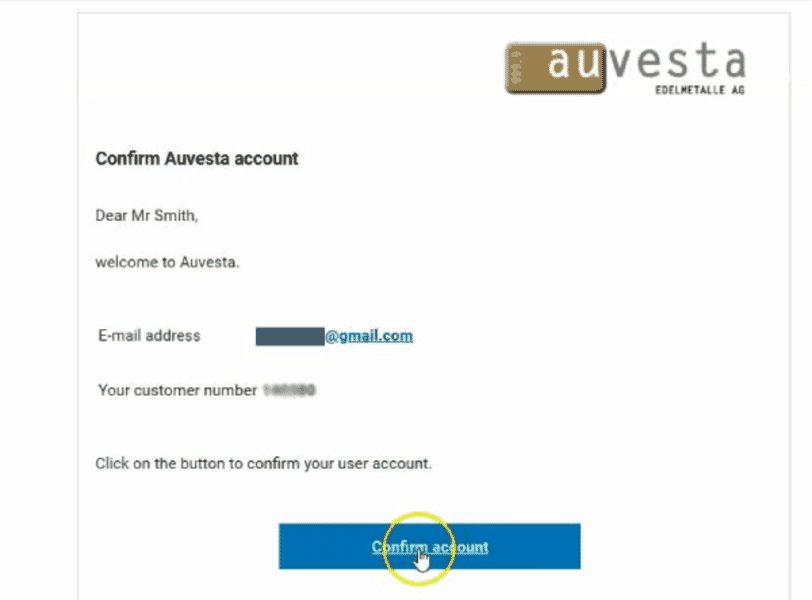

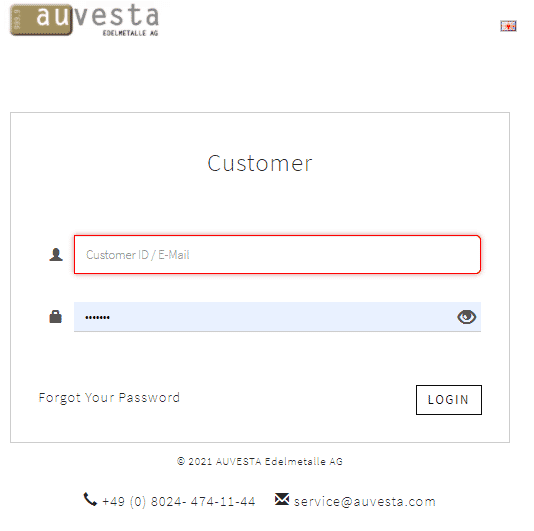

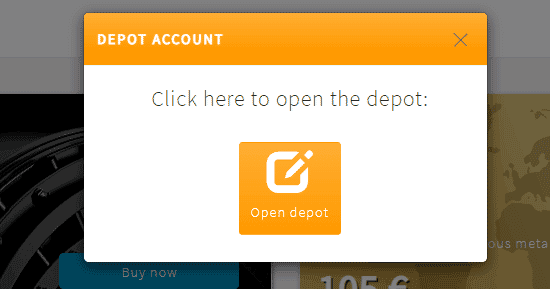

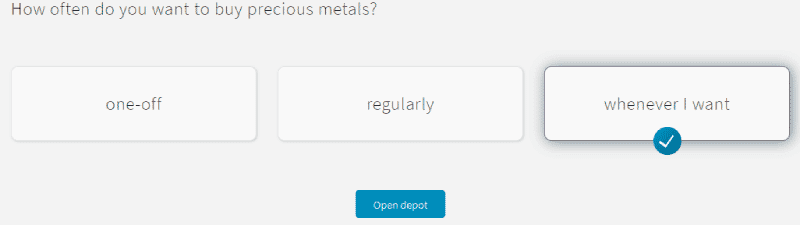

To open a plan in Auvesta, it is very simple. Here I explain it to you step by step:

And confirm the account by clicking on the button "Confirm Account"

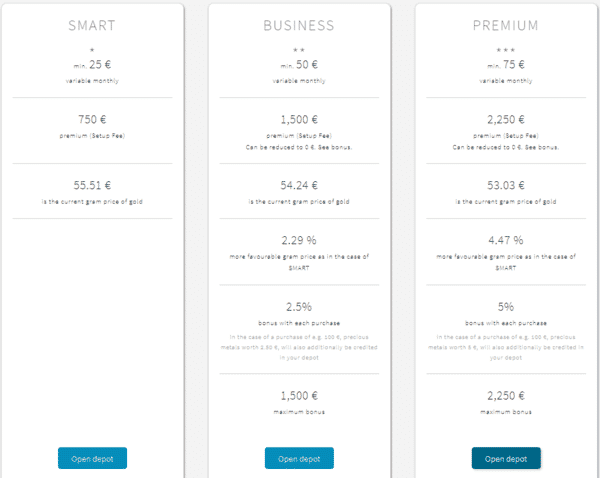

We mark the one we want and click on the button "** open deposit **"

If the plan is a savings plan, we will choose the premium account, since it is the only one where we can recover the entire premium.

The Smart and Business accounts, in addition to having the most expensive price, do not allow us to recover the initial premium in full.

We click on "Open deposit"

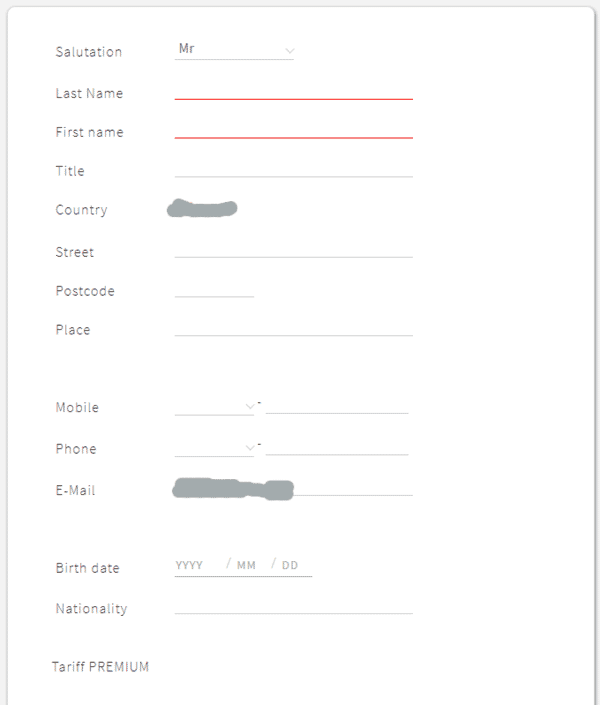

In this part we see the data with which we registered and we will also have to put some new ones

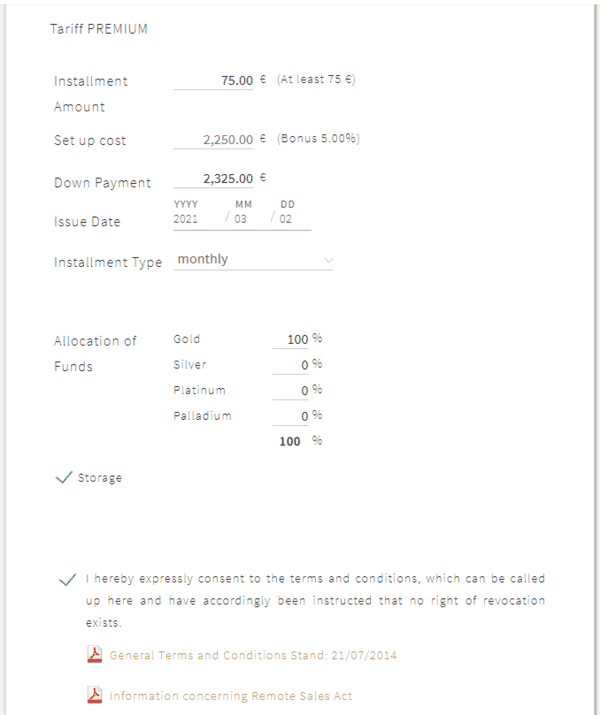

In this part of the form we enter the account start data.

We can choose the quantity destined to gold, silver, platinum or palladium. By default it is 100% to gold, although we can change it now or later.

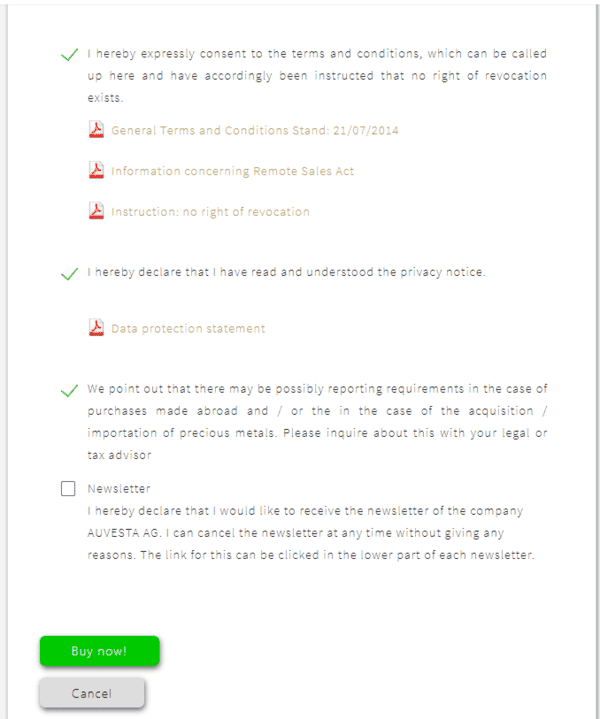

We mark all the boxes if we agree with the conditions and when we mark all the "Buy now" button below it will turn green.

We click and our deposit will be created.

We upload the documents from our account control panel

You will receive 2 emails:

The company has procedures to comply with the money laundering law, so the first contribution is by bank transfer, then you can make the contributions by credit card or paypal.

Here is the link for you to open your deposit in gold:

If you have any questions contact us and we will clarify them