How to Invest in Gold - Complete Investment Guide

"In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value.

Alan Greenspan - Ex Chairman of the Federal Reserve (FED)

This is one of the reasons why most investors tend to invest in gold, as an asset protection against the erosion of their savings due to inflation.

In this guide I will show you all the fundamental aspects about how to invest in gold, whether physical, paper or coins.

I will also explain step by step how to open a gold savings plan to protect your retirement.

Gold Purity

The purity or grade of gold defines the amount of precious metal present in a precious metal alloy.

It can be measured in:

- Thousandths: number of metal parts in every thousand parts of an alloy. It is the official unit

- Percentage: number of metal parts in every 100 parts of an alloy

- Carat: carat is defined as 1/24 of the precious metal alloy which corresponds to 41.66 thousandths. It is possibly the best known and was the official measure until the decimal metric system was adopted.

To ensure that your gold coins are categorized as investment gold, you can check it in the Official Journal of the European Union that is issued annually.

Requirements for a metal to be considered Investment Gold

It will depend on whether it is gold bars or coins.

Ingots:

- Purity is equal to or greater than 995 thousandths or 99.5%

Currencies:

- Purity must be equal to or greater than 900 thousandths

- They must be minted from the year 1800

- They must be or have been legal tender

- They are traded for a value not exceeding 80% of the market value of gold. This excludes coins with high numismatic value because of their rarity.

In some countries a minimum amount of precious metal is defined to be considered investment gold.

This is important since this type of product can carry a more advantageous tax regime.

Taxation of gold - How is investment gold taxed?

VAT

Investment gold is exempt from VAT in the European Union. This special tax regime exempts the payment of VAT in purchase and sale operations.

Tax return

The sale of physical gold is considered a patrimonial alteration (gain or loss) and therefore must be declared as according to the taxable base of the savings, as it happens with any action of a company or ETF.

Ways to invest in gold

Invest in gold ETFs (futures, options, certificates)

They are investment instruments where the underlying is gold.

There are different instruments, such as ETFs, futures, options, certificates or investment funds listed in gold among others.

These assign a certain amount of gold to each of the contracts.

These types of contracts do not directly grant ownership of the gold to investors.

This is one of the important points that make paper gold is considered by many detractors as a speculative market and not conservative like physical gold.

According to analysts, banks trade a number of contracts well above the value of the gold in custody.

This implies that when an investor requests the delivery of the amount of gold that corresponds to him by contract, the entity gives him the value of the gold in paper money.

If true, this could cause a liquidity crisis when all investors claim their share of the metal.

"Good Delivery" Gold Bars

One of the main forms of investment in physical gold is in gold bars.

According to the Gold Focus 2019 report, in 2019 about 800 tons of bars were sold, as in 2018.

Sales were concentrated between Southeast Asia, Europe and the United States.

The most common format is the 400-ounce format that weighs about 12.44 kg and is the one stored in the vaults of central banks.

We also find smaller formats for individual investors, from 1 gram to 1 kg. These are made by stamping the gold foils rather than melting the metal.

The variety of sizes makes it more attractive to small investors. Being able to start from € 50 with the advantage of tax exemption because it is investment gold.

It is important to verify that it is "Good Delivery" bullion to have all the guarantees of sale and to verify that it remains in a sealed blister with its quality certificate.

Investment gold coins or Bullion

They are investment coins or bullion whose value is greater due to the amount of precious metal they contain and its purity together with its numismatic value.

In 2019, some 300 tons of coins were sold according to Gold Focus 2019.

Among the most famous are:

- The South African Krugerrand, which was the first investment currency created in 1967

- French Napoleons

- United States American Eagle

- The Austrian Philharmonic

- The Canadian maple leaf or

- the British Sovereign

- The Chinese panda

The format usually ranges from one ounce, which is 31.1 grams, to 1/20 of an ounce.

As they are considered investment gold, they are also tax exempt.

Collectible Coins

They are coins that are minted in precious metal but do not have the category of investment gold.

They can be struck with a wide variety of motifs and their great finish can also make them interesting for investors.

Jewelry

Investing in gold jewelry is another similar alternative to coins.

In this case, purity and caquality of the pieces, since a 24 carat gold jewel is not the same as 18 carat gold.

Shares of mining companies

This would be an indirect way to invest in gold. Buying shares of mining companies that deal with extraction.

It is not an investment in physical gold since it is associated with the volatility of the financial markets and depends on the financial results of the company, production costs and other variables that are more difficult to control.

Digital Gold

The emergence of cryptocurrencies and the blockchain have brought the emergence of new forms of investment in digital gold.

Backed by the blockchain, which is the technology of cryptocurrencies, a new way of investment has appeared that allows exchange without intermediaries. The same thing happens with cryptocurrencies.

Promoted by various companies and even the British Royal Mint, they have allowed small investors to access the precious metal from their mobile phone.

Despite the fact that technology always facilitates the processes, there is still doubt as to the safety of this type of investment, since we never know if there will really be enough gold for each investor.

Gold investment plans

In recent years this type of investment has become fashionable, which consists of making small regular purchases of gold to create your own gold heritage with all the advantages of investment gold.

This type of investment works like a savings plan and is an alternative to traditional pension plans.

This type of savings has the security, flexibility and most importantly, the possibility of making the gold liquid at any time.

There are several companies that provide this service, such as Auvesta's gold savings plan

The gold or precious metal remains stored in vaults of companies specialized in the custody of precious metals such as Brinks, Loomis and Prosegur.

Why invest in gold

Gold has always passed on security for generations. For this reason, it was the standard currency of reference until relatively recently.

Furthermore, it has been classified as a safe haven asset par excellence, since it has always performed better than financial markets in times of crisis and economic instability.

"Gold is Money. Everything else is credit "- JP Morgan in 1912

What it comes to say: "Gold is money, everything else is credit"

In addition to being an asset haven, there is a growing demand for electronics and jewelry. Therefore, since it is a finite good, its value always tends to rise.

Possession of physical gold has always been one of the oldest ways to protect our savings and wealth.

Where to buy gold

Currently we can do it physically and online.

There are several companies that offer the necessary guarantees to be able to do it safely that I will show you later on.

How to choose a trusted provider

When it comes to investing in physical gold one of the most common problems is being cheated.

For this reason, before buying gold you must take certain precautions:

The gold must come from refineries certified by the LBMA (London Bullion Market Association)

- Heraeus

- Argor Heraeus

- Metalor

- Umicor

- Boliden

- Agosi

- ...

Exercise extreme caution if the purchase is made on second-hand pages such as Ebay or Wallapop. Always require the purchase invoice

To avoid these risks, there are specialized companies that minimize this type of problem and offer us the necessary security.

How to buy gold online?

From a web page or an application you can access the gold.

Currently there are several companies that sell gold online:

- Inversoro (Do not confuse with us!)

- Auvesta

- Andorran Jewelry

- BullionVault

- Coininvest

Where to store gold, how to store it

This is one of the most delicate points, since due to its great value for the small size it is susceptible to being stolen. An ingot takes up less than a brick.

There are 3 possibilities:

-

At the investor's domicile

If you are one of those who like to have it close to you, this is your option, but your insurance may not be enough and there is always a certain insecurity. You must take out a policy that covers your investment.

-

Rent a safe at a bank

This option is more secure than the first, the only drawback is the cost of storage of this type of safe.

Costs can be an important detail that minimizes the revaluation of our investment.

There is also the "Bail In" law, a European law that does not make it clear whether the investor is fully protected against the possible internal recapitalization of the bank in case of bankruptcy.

-

Store it in vaults of specialized companies

There are providers that offer you this possibility. TOIn addition to selling you the gold, they store it in professional custody companies such as Brinks, Loomis and Prosegur.

The main advantage is usually the insurance and the custody price, which is considerably lower than a bank safe deposit box.

Difference between allocated and unallocated gold

Once we are clear that we want to store it in security vaults, we must decide if we want our gold to be assigned or not.

Assigned gold is where the buyer has legal ownership of the metal and unassigned gold is when there is no explicit assignment.

The difference is quite important since the storage price is higher in the case of assigned gold. Also, no one except the owner can move the gold. The owner has a serial number that corresponds to a particular bar.

By not having a serial number assigned this can make us think that our gold is not assigned.

In the case of unallocated gold, the investor does not own any particular piece, it is the company or custodian that has a debt with the client.

To understand it better, it is like when we deposit money in a bank account. There is usually no problem, but in case of financial problems on the part of the entity in which the gold is deposited, the client could be affected.

This does not happen in the case of assigned gold where the owner is perfectly identified.

Investors often compare operators based on purchase price and do not usually look at these details that can be important to compare what each provider offers.

When to invest in gold?

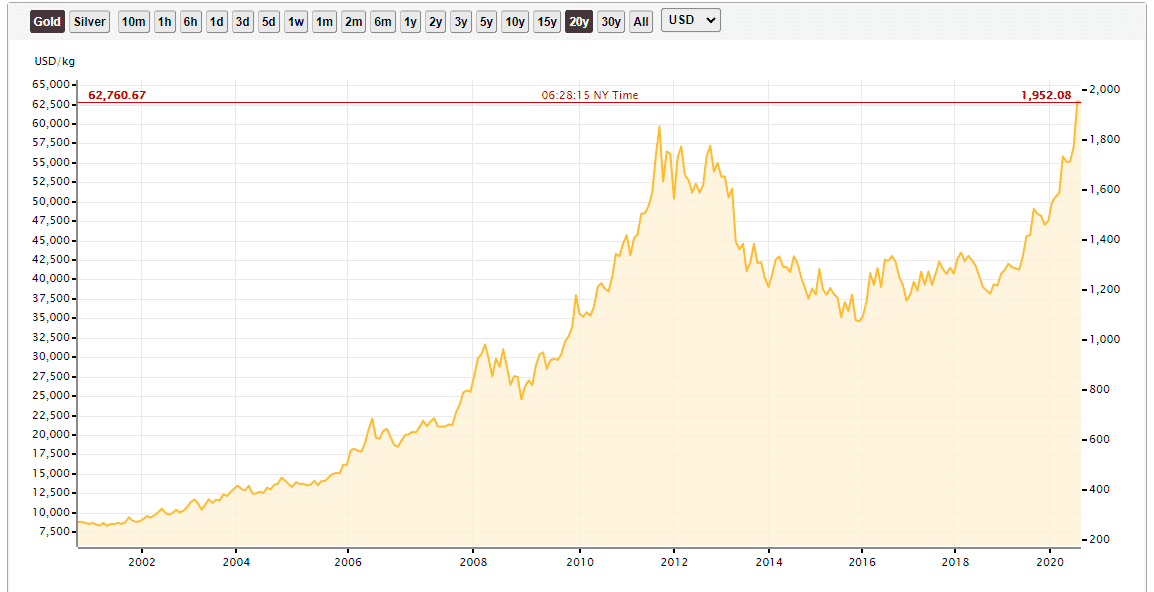

If we look at the gold chart we see that the best time was from 2000-2006 before the economic crisis of 2008.

Nowadays we always wonder if it is a good time or is it already expensive.

Unfortunately we cannot know what will happen in the future, but what is in our power is to have a strategy whatever the moment.

For example, one strategy would be to make a capital accumulation plan, which minimizes our entry risk.

The capital accumulation plan consists of making periodic contributions to be in the market at all times. This would be a way to make a gold savings plan, as we have seen before.

Is it profitable to invest in gold?

Taking a look at the chart again we see that the trend has always been bullish. But we must not get carried away by this detail, the price can go up and it can go down.

The fact that it is a finite metal in nature, added to the growing demand for electronic devices and the jewelry sector, can make us think that the trajectory will continue to be upward.

Gold Price - How is the price set and why

This is a point where there are perhaps more doubts among new investors.

It is logical, since we have different gold prices:

-

Spot price of gold.

It is the price for immediate transactions. The transaction is completed within 48 hours at most. Quote 23 hours a day. It reflects the price at each moment and represents the average of the sale prices of many banks.

-

London fixing price

It is set 2 times a day, at 9:00 am and 3:00 pm GMT. The most important member banks of the LBMA get together and fix the price over the phone, which is usually the official price of gold.

-

COMEX Gold Price (Futures)

It is a futures market with a much smaller volume than the London one, but which to some extent replicates the London market.

Advantages and disadvantages of investing in investment gold

Advantage

- Many different forms of investment

- It is a liquid product

- It has no taxes

Disadvantages

- Physical gold takes up space and requires storage

Learn how to create a savings plan without the risks of storage